In today’s fast-evolving cryptocurrency landscape, mining remains a cornerstone that underpins the decentralized ethos of digital currencies like Bitcoin, Ethereum, and Dogecoin. However, the profitability of mining ventures hinges critically on the hardware employed. Particularly in the USA, where energy costs and regulatory frameworks vary widely, selecting the optimal mining machine is paramount for maximizing return on investment (ROI). This article dives deep into a comparative review of leading USA mining hardware, dissecting which rigs and hosting solutions truly deliver value for miners aiming to capitalize on this lucrative sector.

The sheer variety of mining machines available for Bitcoin (BTC), Ethereum (ETH), and even altcoins like Dogecoin (DOG) can make the decision-making process bewildering. ASIC miners—tailored for specific algorithms—dominate BTC mining, with models like the Antminer S19 Pro and Whatsminer M30S++ leading the charge. These machines boast unparalleled hash rates, efficiently processing transactions on the Bitcoin blockchain, but their steep upfront costs and energy appetite compel users to consider hosting or colocation strategies meticulously. Conversely, Ethereum mining, reliant on the Ethash algorithm, favors GPU-based mining rigs, which provide flexibility not only for ETH but also for other compatible coins.

Mining farms in the USA have proliferated rapidly, marrying cutting-edge hardware with access to low-cost and renewable energy sources. Locations such as Texas and Washington State have become hubs for these operations, leveraging their electrical infrastructure and climate conditions to suppress operational costs. Hosting mining machines in such environments reduces downtime caused by overheating and provides miners the peace of mind to focus on strategy rather than equipment maintenance. What’s more, professional hosting services offer comprehensive monitoring, security, and maintenance—factors that significantly augment the lifespan and efficiency of mining rigs.

From the miner’s perspective, the decision matrix involves balancing upfront costs, electricity consumption (measured in watts per terahash), machine lifespan, and hash rate output. For BTC miners, the cutting-edge ASICs exhibit formidable performance metrics, often exceeding 100 TH/s, but can consume upwards of 3000 watts. Trade-offs become clearer when juxtaposed with GPU rigs, which may deliver lower hash rates but offer versatility—especially as Ethereum transitions to Proof-of-Stake, potentially reducing its mining viability. Thus, eth miners are increasingly exploring other altcoins, including Dogecoin, applying their rigs in multi-algorithm setups to diversify income streams and hedge against market fluctuations.

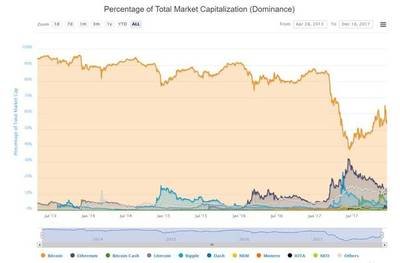

Exchanges and the broader crypto ecosystem also indirectly influence mining hardware ROI through market volatility and network difficulty adjustments. Bitcoin’s halving events, which slash block rewards every four years, necessitate continuous evaluation of mining strategies. Miners must adapt swiftly by upgrading hardware or optimizing hosting agreements. Furthermore, the emergence of DeFi platforms and NFT marketplaces has driven a surge in Ethereum’s transaction volume, temporarily boosting ETH mining profits before the anticipated migration to Ethereum 2.0’s Proof-of-Stake consensus. Meanwhile, Dogecoin, initially a meme coin, has transformed into a noteworthy mining target owing to its Scrypt algorithm and community-driven momentum. This diversification in mined assets gives miners leverage to pivot hardware usage dynamically, squeezed between energy economics and blockchain incentives.

Hosting mining machines in the USA blends technical sophistication with practical business acumen. Selecting a hosting provider involves scrutiny of uptime guarantees, cooling solutions, network latency, and geographical risks such as extreme weather or regulatory shifts. Advanced miners often deploy remote management tools, enabling granular control over their equipment across multiple hosting sites. Integration with smart grid and renewable energy initiatives further lowers electricity expenses, enhancing margins. An increasingly popular strategy involves ASIC rental or hosting contracts, allowing miners to lease machines without large capital expenditures while benefiting from professional farm management.

In sum, the quest for the best ROI in USA mining hardware is a multi-faceted endeavor. ASIC miners reign supreme in the Bitcoin realm, while GPU rigs maintain their relevance for Ethereum and altcoin mining. The rise of robust mining farms and hosting solutions accentuates the importance of operational efficiency alongside raw computational power. Amid market volatility and technological shifts, miners who blend strategic hardware selection with intelligent hosting can unlock superior profitability and sustainability. As cryptocurrency ecosystems continue to innovate, the dynamic interplay of mining hardware and hosting services will undoubtedly remain the pulse of decentralized finance.

Leave a Reply to Conflux Cancel reply