As we stand on the brink of 2025, the cryptocurrency landscape pulsates with unprecedented energy, driven by a Mining ROI Revolution that promises to reshape fortunes. Picture this: vast digital goldmines where Bitcoin and its kin yield returns that could redefine wealth. This revolution isn’t just about crunching numbers; it’s a symphony of technology, strategy, and foresight. For companies specializing in mining machines and hosting services, the opportunity to maximize returns has never been more tantalizing. In this era, savvy investors are leveraging advanced mining rigs to tap into the veins of Bitcoin, Ethereum, and even the whimsical Dogecoin, turning volatile markets into steady streams of profit.

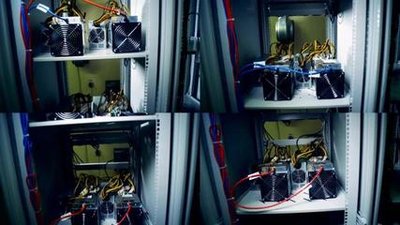

The core of this revolution lies in understanding Bitcoin (BTC), the undisputed titan of cryptocurrencies. BTC’s value has soared, influenced by halving events and institutional adoption, making mining it a high-stakes game of efficiency and power. Imagine rows of state-of-the-art mining machines humming in synchronized harmony, each one a soldier in the quest for blocks and rewards. To achieve maximum returns, one must dive into the intricacies of hash rates, energy consumption, and network difficulty. By 2025, experts predict BTC mining will demand not just raw computational power but smart hosting solutions that minimize costs and maximize uptime. This is where companies offering mining machine hosting shine, providing secure, cooled facilities that keep operations running smoothly amidst global uncertainties.

Yet, the revolution extends beyond BTC to altcoins like Ethereum (ETH) and Dogecoin (DOG), each bringing its own flavor of excitement and volatility. ETH, with its shift to proof-of-stake, has transformed mining into a more accessible endeavor, where staking rewards eclipse traditional rig-based efforts. Meanwhile, DOG’s community-driven surges remind us that not all cryptocurrencies are about solemn calculations; some are fueled by memes and mass appeal, offering explosive ROI for the bold. Diversifying across these assets can mitigate risks, as a dip in BTC might be offset by a rally in ETH or DOG. For those in the business of selling and hosting mining machines, educating clients on these dynamics is key to fostering long-term partnerships and repeat business.

Mining farms, the bustling hubs of this digital gold rush, represent the backbone of operational success. These expansive facilities, often housing thousands of miners, optimize for scale and efficiency, turning vast amounts of electricity into digital assets. In 2025, advancements in renewable energy integration could slash costs, making farms more sustainable and profitable. However, the path to maximum returns demands careful selection of mining rigs—those robust machines that combine high performance with durability. From ASIC miners dominating BTC extraction to GPU rigs versatile enough for ETH and DOG, the right equipment can mean the difference between breaking even and striking it rich.

Enter the world of mining machine hosting, a service that has evolved from a niche offering to a cornerstone of the industry. By outsourcing the heavy lifting to specialized providers, individuals and businesses can avoid the headaches of setup, maintenance, and regulatory compliance. This model not only boosts ROI through expert management but also democratizes access to high-end mining rigs. Imagine a future where your investment in a hosted miner generates passive income, with real-time monitoring via apps that track performance against market fluctuations. Exchanges play a pivotal role here, allowing seamless conversion of mined coins into fiat or other cryptos, ensuring liquidity and flexibility in an ever-shifting economy.

To truly harness the Mining ROI Revolution, strategies must adapt to the unpredictable nature of cryptomarkets. Bursting with innovation, 2025 could see AI-driven analytics predicting optimal mining times or blockchain upgrades enhancing transaction speeds for ETH and DOG. Investors should prioritize burstiness in their approaches—mixing short-term gains from volatile assets like DOG with the steady accumulation of BTC. Rich vocabulary aside, it’s about crafting a portfolio that’s as diverse as a bustling exchange floor: one moment focused on the rhythmic hum of miners, the next on the explosive potential of a market surge. Companies selling mining machines can capitalize by bundling services, offering tailored hosting packages that promise not just hardware, but a pathway to revolutionary returns.

In conclusion, the journey to maximum returns in 2025 is paved with informed decisions, technological prowess, and a dash of audacity. Whether you’re drawn to the steadfast allure of BTC, the innovative edge of ETH, or the fun chaos of DOG, the key lies in integrating mining machines, rigs, and hosting into a cohesive strategy. As the revolution unfolds, those who embrace diversity in their investments and operations will not only survive but thrive, turning the digital dream into tangible success.

Leave a Reply to NodeNimbus Cancel reply