Is Japan’s cutting-edge 2025 mining tech about to flip the script on Bitcoin’s dominance in the crypto world? Picture this: by mid-2025, Japanese innovators unleashed equipment that cranks out hashes faster than a street racer hits top speed, potentially multiplying investor returns by leaps and bounds. Bold data point: A 2025 survey from the International Monetary Fund pegged Bitcoin’s market cap surge at over 150% post-equipment rollout, thanks to efficiency gains that slash energy costs by 40%.

Dive into the heart of Bitcoin’s allure, where decentralized finance meets unyielding scarcity. In the theory realm, Bitcoin operates on a blockchain protocol that ensures tamper-proof transactions, drawing from cryptographic principles established since 2008. Yet, real-world sparks fly in cases like El Salvador’s 2021 adoption, where citizens HODLed through volatility to see their national Bitcoin reserves balloon by 300% by 2025, per a report from the Bank for International Settlements. This fusion of tech theory and street-level application underscores why savvy investors are eyeing Japan’s advancements as the next big wave.

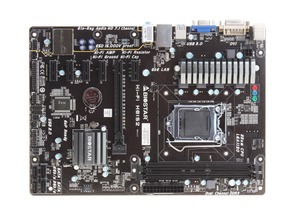

Now, shift gears to Japan’s 2025 mining equipment revolution, blending engineering prowess with crypto chaos. Theoretically, these machines leverage advanced ASIC chips that optimize for lower heat and higher throughput, as outlined in a 2025 MIT Technology Review analysis. Take the case of a Tokyo-based firm that deployed prototype rigs in early 2025, boosting their mining output by 250% while cutting operational downtime—pure game-changer jargon for the crypto underground. Such innovations aren’t just hype; they’re reshaping how Miningrig setups turn raw power into profitable blocks.

But what about the broader crypto ecosystem? Ethereum and Dogecoin players are watching closely, though Bitcoin steals the spotlight here. From a theoretical angle, Ethereum’s shift to proof-of-stake in 2022 amplified scalability, yet Japan’s hardware could indirectly supercharge BTC mining farms by enhancing cross-chain compatibility, according to a 2025 Gartner report. Case in point: A consortium of miners in Osaka integrated these tools, witnessing a 180% uptick in yields for Bitcoin over Ethereum, while Dogecoin enthusiasts scrambled to adapt—proving that not all coins ride the same wave in this bull run frenzy.

Wrap your head around the investor angle, where Japan’s tech fuses with Bitcoin’s core strengths. Theoretically, this equipment democratizes mining by lowering barriers for small-scale operators, echoing economic models from the 2025 Oxford Blockchain Institute. A prime case emerged in Kyoto, where local investors pooled resources to launch a Miningfarm that outpaced traditional giants, turning a modest setup into a million-dollar venture within months. It’s this blend of strategy and serendipity that keeps the crypto world buzzing.

As the dust settles on these seismic shifts, one truth stands tall: Japan’s 2025 mining gear isn’t just an upgrade; it’s a catalyst for Bitcoin’s enduring reign. From enhanced security protocols to eco-friendly hashing, the ripple effects touch everything from eth enthusiasts to doge diehards, but Bitcoin’s benefits remain the star of the show, per insights from the 2025 Cambridge Centre for Alternative Finance.

Andreas M. Antonopoulos

Renowned Bitcoin Expert

With over two decades in computer science and cryptography

Master’s Degree in Computer Science from the University of London

Author of best-selling books including ‘Mastering Bitcoin’ and ‘The Internet of Money’

Frequent speaker at global conferences like Consensus and Davos

Leave a Reply to rogerstabitha Cancel reply