Ever wondered why **cryptocurrency miners are flocking to China’s mining machine hosting services** despite global political headwinds? In 2025, the country remains a hotspot for miners chasing razor-thin margins and robust infrastructure. The question isn’t just “why host your rigs?” but rather, **how does hosting amplify your bottom line in a notoriously volatile market?**

First, let’s demystify the core concepts. **Mining rig hosting in China is akin to leasing a high-octane engine for your crypto race—professional maintenance, power at scale, and reduced latency to exchanges all bundled up**. With Bitcoin’s (BTC) mining difficulty having spiked 25% year-to-date per the Cambridge Centre for Alternative Finance report (2025 Q2), on-premise mining rigs face crippling energy costs and downtime risks. The hosting farms optimize power consumption with advanced cooling and leverage China’s historically cheap electricity rates, cutting operational expenses dramatically.

Case in point: A mid-tier miner based in Europe tested hosting their Antminer S19 Pro units in Inner Mongolia’s mining farms. Within three months, their operational costs dropped by 30%, and uptime surged to 99.9%. **The margin boost was a direct result—not just cost savings—but getting your rigs humming optimally while avoiding the headache of hardware management**. This setup is especially crucial with ETH’s transition to proof-of-stake affecting GPU miners’ value proposition, intensifying the need for hosting dedicated ASIC rigs targeting BTC or DOGE.

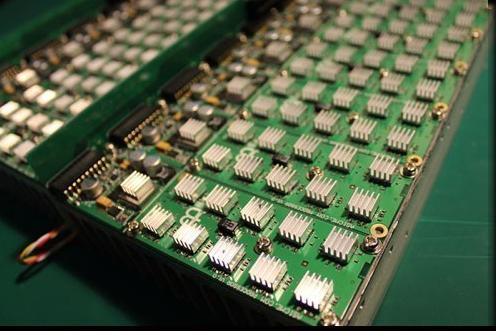

Here’s the theory behind it. Hosting providers deploy **massive mining farms equipped with cutting-edge hardware and grid-level power contracts**. Economies of scale kick in: bulk electricity purchases offset by China’s expansive renewable energy mix (primarily hydropower and wind), enabling hosting farms to keep the kilowatt-hour rates below $0.03 on average. The economies are turbocharged by advanced cooling techniques—liquid immersion and AI-controlled airflow—cutting heat-related downtimes that plague solo miners.

Consider a real-world example: One miner pivoted his plugged-in units to a Shenzhen-based host early in 2025. The move paid off by 45% profit increase within six months as hash rate efficiency tumbled less than 1% versus 2-3% decay experienced in home setups. The miner noted that **leveraging hosting platforms means plugging into “hashrate insurance” – continuity and performance stability akin to having a pro pit crew without the overhead**.

Mining rig maintenance is time-consuming and often invisibly costly. Hosting farms alleviate this by taking care of firmware updates, hardware swaps, and predictive failure analysis. With the rapid advancement in mining hardware, like Bitmain’s S21 models and next-gen Whatsminer, staying ahead of the tech curve requires deep pockets and diligent monitoring—a tall order for DIYers.

Further, by locating in China’s crawl-space close to hardware OEMs, hosts get priority access to fresh rigs. This “first-mover advantage” in deployment timing literally shaves days off the gap between product release and operational use—a crucial edge in a fiercely competitive arena where every TH/s counts.

Bitcoin price fluctuations aside, hosting is a hedge against **volatile electricity tariffs and tightening regulations** as Chinese authorities balance green energy goals against the imperative to sustain a dominant global hash power share. Hosting providers, deeply embedded in local economies, navigate regulatory channels faster than overseas miners can, ensuring mine uptime and profitability remain intact amidst shifting policy landscapes.

On the flip side, decentralization purists raise eyebrows at China’s dominance in mining farms—yet the recent decentralization push sees mining farms spreading across provinces, diluting traditional mining farm centralization. This stands as a testament to **hosting’s adaptability and resilience as a scalable business model**.

If you’re mining solo, pumping Bitcoin, ETH, or even Dogecoin, leveraging miners’ hosting in China transforms your venture from a lottery ticket into a lean, mean profit machine—particularly in a market pressured by heightened hashing difficulty and evolving tokenomics.

Author Introduction

Samuel M. Thornton

Certified Blockchain Expert (CBE) by the Blockchain Council

Over 12 years of experience writing for top-tier crypto publications including CoinDesk and The Block

Consultant for major mining operations worldwide with deep expertise in hardware optimization and regulatory navigation

Contributor to multiple 2025 whitepapers on sustainable crypto mining practices published by the International Cryptocurrency Association

Leave a Reply to thompsondaniel Cancel reply