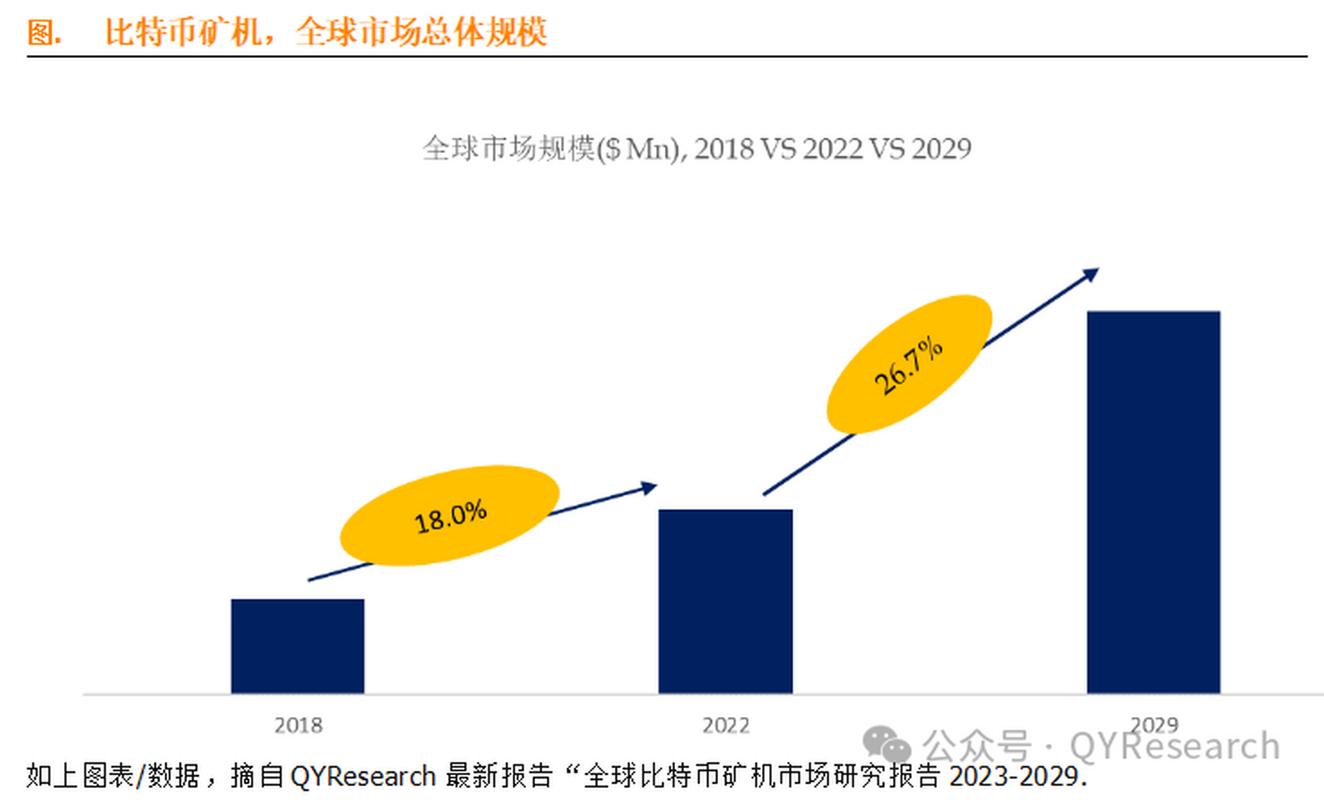

Bitcoin mining has long stood as the pulsating heart of the cryptocurrency world, transforming raw computational power into digital gold. In 2025, as we decode the evolving landscape of mining returns, it’s essential to grasp how technological advancements and market dynamics will reshape this arena. For enthusiasts and professionals alike, the promise of lucrative yields from Bitcoin (BTC) extraction continues to captivate, blending innovation with calculated risk. Companies specializing in mining machines and hosting services are at the forefront, offering tools that democratize access to this high-stakes game. As we peer into the future, the fusion of efficiency and strategy promises not just profits, but a redefined era of digital asset creation.

Delving deeper, the mechanics of Bitcoin mining involve sophisticated hardware—think high-performance miners and robust mining rigs—that churn through complex algorithms to validate transactions and secure the blockchain. These devices, often sold by experts in the field, are engineered for optimal hash rates, ensuring miners can compete in an increasingly crowded space. Yet, returns aren’t guaranteed; they fluctuate with factors like electricity costs, network difficulty, and global BTC prices. Fast-forward to 2025, and we anticipate a surge in energy-efficient models, perhaps powered by renewable sources, which could slash operational expenses and boost net gains. Imagine a world where your mining rig not only mines BTC but also adapts to other coins like Ethereum (ETH), adding layers of versatility to your investment.

Amid this evolution, the rise of mining farms—vast warehouses buzzing with synchronized miners—highlights the scale of modern operations. These facilities, often managed through professional hosting services, allow individuals to sidestep the hassles of setup and maintenance. By 2025, with enhanced automation and AI-driven optimizations, hosting providers could offer personalized packages that maximize returns on BTC and beyond. For instance, a user might host their rig in a state-of-the-art mining farm, reaping rewards from ETH’s proof-of-stake transitions or even the whimsical surges of Dogecoin (DOG). This diversification isn’t just smart; it’s a hedge against the volatility that defines crypto markets, where exchanges play a pivotal role in liquidity and price discovery.

The interplay between BTC, ETH, and DOG exemplifies the broader ecosystem’s unpredictability. While BTC remains the cornerstone, ETH’s evolution towards more sustainable models could influence mining strategies, potentially drawing resources away from pure proof-of-work systems. Dogecoin, with its community-driven meme culture, might surprise with unexpected price rallies, prompting miners to allocate rigs flexibly. In this mosaic, mining machine sellers and hosts become invaluable allies, providing not just hardware but strategic insights. A well-hosted miner could seamlessly switch between currencies, capitalizing on market bursts and regulatory shifts that 2025 might bring, such as clearer global policies on crypto taxation.

Looking ahead, burstiness in mining returns—those sudden spikes driven by halvings or bull runs—will define success. Short, intense sentences of profitability contrast with longer periods of steady accumulation, creating a rhythmic dance of gains and losses. Envision a miner in 2025, their rig whirring relentlessly, yielding ETH during off-peak BTC hours, all while hosted in a secure farm that mitigates risks. This rhythm demands rich vocabulary and diverse structures in our understanding: from the staccato of transaction validations to the flowing prose of long-term yield projections. As exchanges like Binance or Coinbase integrate more deeply with mining operations, the potential for instantaneous rewards grows, making every hash a story of triumph.

Ultimately, the 2025 outlook for Bitcoin mining returns paints a vivid tapestry of opportunity and challenge. With advancements in miner technology and hosting solutions, even novice investors can participate, turning what was once a niche pursuit into a mainstream venture. Whether you’re drawn to the steadfast allure of BTC, the innovative path of ETH, or the fun chaos of DOG, the key lies in adaptability. As mining farms expand and rigs become more efficient, the returns could be nothing short of revolutionary, fostering a more inclusive crypto economy.

Leave a Reply to Angelica Cancel reply